Private Clients

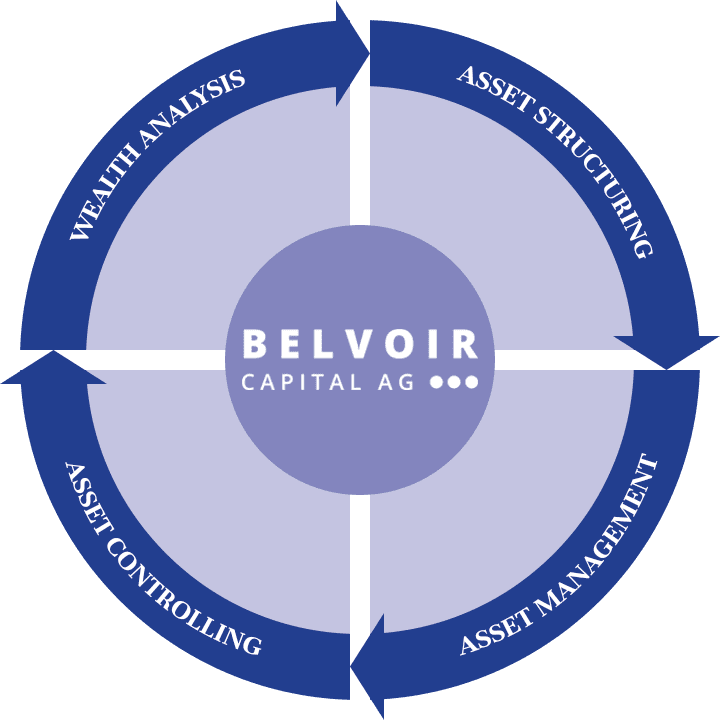

A detailed analysis serves as the basis for the correct structuring of your assets. We want to understand your needs and expectations, your risk tolerance and your risk capacity. Active questioning enables us to determine the right targets for your investment.

Together we develop the tailored and bespoke principles. At this stage, we clarify which asset classes are suitable for your investment. Should asset classes be excluded or limited in amount? The selection of the right custodian and the tailor-made asset management agreement complete the asset structuring process.

Our experienced portfolio managers carry out the execution focused asset management mandate. We manage our clients’ mandates using a multi-asset approach. Belvoir’s Investment Committee recommendations for asset classes and investment instruments are incorporated directly into your portfolio composition from a conscientious and long-term perspective. We regularly assess the economic and political conditions that influence the growth of your assets and make independent adjustments in your interest. Risk management and opportunity management complement each other overtime.

We monitor your investments via our in-house system. Does the evolution of your portfolio still fit defined targets? Did we consistently capitalize on market opportunities? You will regularly receive detailed reports on the performance of your assets and your client advisor will always be available for a personal meeting.

Family Office

Belvoir Capital is a multi-family office.

We are happy to share our wealth of experience in providing holistic advice and support to families and clients.

Institutional Clients

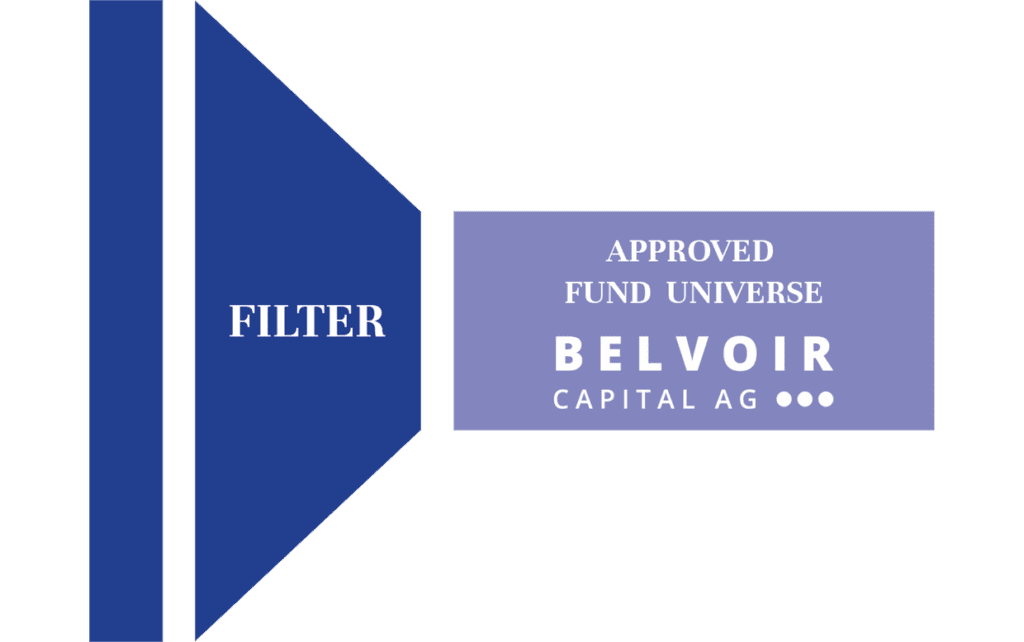

We provide our institutional clients with access to the best investment managers in the world. We grant access to these managers via investment funds that have undergone our rigorous selection process. Our specialty lies in the assessment of actively managed funds. This is a key component of us supporting our clients in meeting the challenges associated with their asset-liability management.

We identify the appropriate investment fund in a complex, four-stage process:

- Track Record

- Tracking Error

- Fund size and its change

- Correlations

- Up-/Down Side Capture (behaviour in up and down phases, recovery of losses)

- Organization

- Investment approach

- Investment style

- Team/Manager

- History of Manager Changes

- Prospectus review

- Manager presentation

- Corporate structure

- Comparison to the competition

- Investment horizon

- Risk scenarios

- Yield expectation

- Regular review

In a personal conversation you will experience how you can benefit from our knowledge.