“Banking is necessary, not Banks”

Bill Gates coined this sentence in 1998, which describes the challenges facing not only the traditional banking sector, but in principle the entire financial sector.

The financial market crisis, which was brought into the foreground by the Lehman Brothers bankruptcy in 2008, continues to have a negative impact on large parts of the economy, particularly the European banks. A glance at the share price chart of the former industry leader Deutsche Bank AG, represented here, shows a fall of almost 85% in the period between mid-2007, the high point for European bank shares, and February 2009. In 2010, European banks slipped virtually seamlessly into the EURO crisis and have had to fight for their very survival ever since. The age of large universal banks, which offer a comprehensive service for all client segments, has long since passed its apogee. These business models are too lethargic and cumbersome in the age of digitalization.

Despite the fact that banks have always fueled the introduction of technology into their service processes with high investments, they still often lack the flexible infrastructure to keep up with the innovative power of digitization.

What do we mean by FinTech?

The German supervisory authority BAFIN (Bundesaufsichtsamt für Finanzdienstleistungen) gave the following definition in its study on the subject in 2015: “The term “FinTech” is a combination of the words “Financial Services” and “Technology”. A precise definition does not yet exist. FinTechs is commonly understood to mean new companies that use technology-based systems to offer specialized and tailored financial services to specific customer groups. FinTechs follow the trend of digitization and personalization. Their applications are customer-friendly, fast and convenient. However, FinTechs not only have to compete with traditional players such as banks, insurers and securities service providers, but also to some extent supplement their offerings. They drive technological progress in the entire financial market”.

We have seen that companies from the FinTech sector generally concentrate their efforts on a specific aspect of financial services. PayPal and Wirecard with their payment services come to mind as prominent examples. The former, whose roots include the company X.com founded by Elon Musk, achieved its worldwide breakthrough as a payment system for auctions at the online auction house EBAY. According to the company, it now has more than 203 million users worldwide and can process payments in over 100 currencies virtually, quickly and inexpensively with just a few clicks.

In early March, the Munich payment service provider Wirecard made a name for itself when it replaced the venerable Commerzbank in the German DAX share index as an up-and-coming FinTech company. Wirecard regards itself as a leading player in online payment processes and a global innovation driver. While PayPal operates the end customer business (B2C), Wirecard concentrates on the so-called B2B business and sees itself as a service provider for other companies, including banks and credit card companies, who would like to process their payment transactions online.

According to its publication “Long-term investments” of 31 August 2018, UBS divides FinTech into two segments. The horizontal segments are Mobile Applications, Cloud Solutions, Analytics, Social Networks, Blockchain Applications and Artificial Intelligence, while the vertical segment includes Payment Traffic, Capital Markets Tech, Wealth-Tech and Regulatory Technology. In simple terms, technology (how) is defined in the horizontal segment and service or application (what) in the vertical segment.

FinTech Conquers the Market

FinTechs are taking over the easily scalable business segments in particular. The examples of Paypal and Wirecard in the payment transactions segment mentioned above make this clear. However, the entire range of services offered by the traditional banking industry can be analyzed to ascertain the extent to which FinTech already offers or provides solutions. As an example, banking apps are replacing e banking and visits to bank branches. The use of mobile payment systems is reducing cash transactions. In addition, mobile applications from online brokers are replacing securities accounts at banks. FinTech will revolutionize the document-based business in the international movement of goods. In this regard, block chain technology can process transactions faster and safer than the exchange of documents from bank to bank, which in turn initiates or guarantees the payment flow. The entire credit business, be it consumer credit, home mortgages or corporate financing, can now be handled online. The ” Crowd lending Survey 2018 “, which was carried out in cooperation with the Lucerne University of Applied Sciences and Arts, PwC and the Swiss Marketplace Lending Association, identified a total credit volume of 186 million Swiss francs for 2017 in Switzerland with 2,035 brokered loans via platforms in the crowd lending sector.

In 2018, a credit volume of approximately 400-500 million Swiss francs is predicted. This number illustrates the enormous upside potential. With crowd lending, loans are brokered directly between borrower and lender via a platform. Crowd lending can be carried out via dedicated funds or structured credit pools, or directly via a contractual relationship between borrower and lender. These are lucrative opportunities for the investor to invest money in the current negative or low interest rate environment.

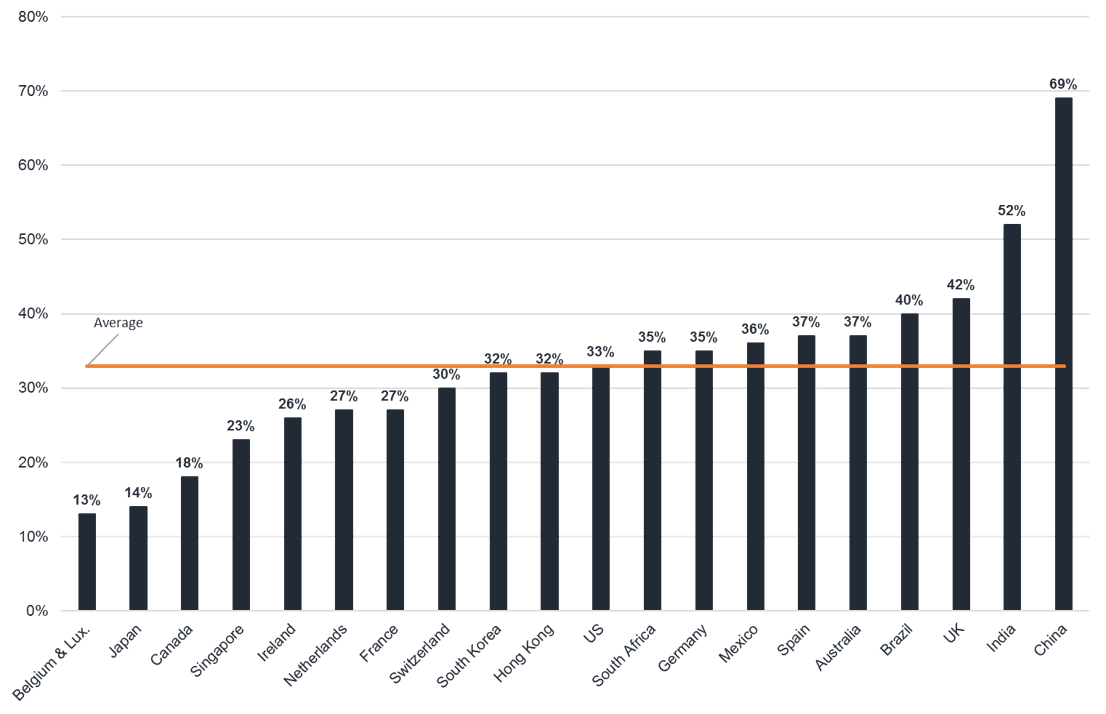

Nevertheless, the figures for the Swiss market appear to be low in the international context. For the US, the volume of 23 billion Swiss francs is 40 times larger and for China, 198 billion Swiss francs is almost 10 times larger than for the US. These statistics show the predominance of the emerging Asian economy. It also illustrates the previously described inertia of banking and the financial system in many established economies.

From Credit Business to Investment

The term crowd lending also represents a change in the way money is invested. These new forms of investment also require further thinking in terms of advice in this segment. Here, too, the banking world is already breaking up. Under the heading known as “open architecture “, banks opened up their product ranges for investment products at the end of the 1990s. Alongside the bank’s own products, third-party products were also increasingly included. These developments were accompanied by an increase in the demand for qualified advice. Simultaneously, the need for more information and staff to select suitable third-party products increased. Furthermore, independent asset managers, some of whom operated their own businesses without any products of their own, became even more important. Originally, this product diversity and flexibility was reserved for very wealthy clients, but in the subsequent years, the barrier to entry was gradually revised downwards.

Today, the business with highly qualified and professional investment products has become suitable for the masses, thanks in part to ongoing digitalization. These investment products have become increasingly scalable and thus a commodity that can be quickly exchanged, easily accessed and inexpensively acquired. WMD Capital GmbH, a Munich-based start-up founded in 2017, has created a platform that gives investors access to the most renowned asset managers with just a few clicks. WMD Capital applies the so-called one-stop-shop principle, in which the investor can complete all the necessary administrative steps (contract with WMD, opening a securities account with the partner bank and selecting asset managers) conveniently and without great effort via the platform.

FinTech enhances the quality of Advisory Services

As defined by UBS, FinTech solutions in the horizontal segment support asset managers and advisors in their day-to-day work. The generated solution can cover parts of the advisory process or its implementation in portfolio management and reporting. The research process on potential customer contacts can be considerably facilitated in the advisory process or even in the preliminary stage of customer acquisition thanks to FinTech solutions. This service goes beyond a pure database application, and usually involves networking and evaluating the data to ensure that the advisor can access the addresses of the asset manager or bank without any dispersed risk. The preparation of new client mandates can be simplified, since regulatory requirements, for instance pertain to the clarification of client information and its suitability for certain strategies and products, which can be handled systematically, online or mobile. From this perspective, opening a client relationship with a bank is now only a relatively small step. Nowadays, there are service providers who carry out the necessary authentication check in real time via video chat.

FinTech makes the advisory process in asset management easier and more efficient than before. Hence, allowing for a more competent, comprehensive and individual approach. The question remains: Are there any areas of investment advice and support that are not scalable? Yes, because the more complex asset structures are, the greater the need for individual solutions which are tailored to the personal situation of the asset owners. On the other hand, this also means that less complex asset situations can be solved efficiently via FinTech.

If the client is well advised, it is a matter of the subsequent execution. The portfolio management teams of the banks and asset managers usually implement the bankable assets. Irrespective of whether the execution takes place through third-party products (e.g. funds) or through direct investment in shares and other securities or a combination of both, FinTech also facilitates the work of the portfolio manager in this area. With the internet, the amount of data available has increased exorbitantly. As recently as 25 years ago, most corporate and stock market news were distributed via print media. Today, a significant part of the news volume is published, posted and shared online in real time. In other words, an immediate valuation of the impact of the actual report on the current investment structure or securities in a customer portfolio is just as vital.

FinTech solutions provide support, particularly when dealing with this amount of data with key words such as big data, cloud computing and analytics. As an example, we would like to use this opportunity to introduce a company called YukkaLab. The company is a Berlin start-up, which describes itself as a technology leader in the field of augmented language intelligence and content-related text analysis. The company relies on artificial intelligence technologies such as machine learning and neural networks (deep learning). Natural Language Processing (NLP), a branch of computer science, provides the ability to filter trends from financial news and automatically assign them to a market segment, an industry or even a company. To put it simply, messages are retrieved, assessed and assigned to the relevant market or company in real time. This service is extremely efficient for the portfolio manager. It provides the portfolio manager with an overview and a sentiment of the stocks and market segments under management at all times. As a result, more time can be invested in the analysis and selection of investment instruments and client strategies with a high degree of individualization and competently managed.

Conclusion:

Traditional business models are subject to fundamental change. Financial service providers should see this as an opportunity to re-think their business models and incorporate FinTech solutions into their processes. FinTech enhances the quality of investment advice. The more scalable a service is in the financial sector, the easier it can be replaced by FinTech solutions. The professional management and implementation of complex asset structures, often found in the area of high-net-worth clients and entrepreneurial families, is supported by FinTech solutions. Consequently, this leads to a higher quality of advice and support. In particular, the next generation of asset owners, many of whom have already become aware of or grown up with the new technologies, will expect their investment advisors to use state-of-the-art technologies to provide them with professional advice. Furthermore, access to the investment advisor should always be possible digitally on all channels via app, social media and the Internet, as well as analogously by letter, telephone and in person.